Depreciation expense calculator for rental property

This rental property calculator allows the user to enter all. Property owners can use two methods to calculate the amount of plant and equipment depreciation they can claim on their rental properties.

Macrs Depreciation Calculator With Formula Nerd Counter

Lets consider the above example for this cost basis.

. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. First one can choose the. So the basis of the.

Rather than taking one large deduction in the year you buy or improve the property. To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. Section 179 deduction dollar limits.

Depreciation is the process used to deduct the costs of buying and improving a rental property. When you rent property to others you must report the rent as income on your taxes. This is known as the.

A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. But you can deduct or subtract your rental expensesthe money you spent in your. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property.

If the home was not available for rent for the full year. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property.

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for. Depreciation in real estate is.

Calculate the Propertys Depreciation Cost. Calculate The Depreciation Schedule For Rental. For example if a new dishwasher was purchased for 600 had an estimated.

To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation. It provides a couple different methods of depreciation.

IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. This limit is reduced by the amount by which the cost of.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Rental Property Depreciation Rules Schedule Recapture

Renting My House While Living Abroad Us And Expat Taxes

Rental Property Calculator Most Accurate Forecast

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation On Rental Property

Rental Property Calculator Most Accurate Forecast

Macrs Depreciation Calculator Irs Publication 946

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Depreciation For Rental Property How To Calculate

How To Calculate Depreciation On A Rental Property

Investing Rental Property Calculator See Cash Flow Statement Depreciation Gross Profit Operati Cash Flow Statement Investing Mortgage Refinance Calculator

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Depreciation Rules Schedule Recapture

Residential Rental Property Depreciation Calculation Depreciation Guru

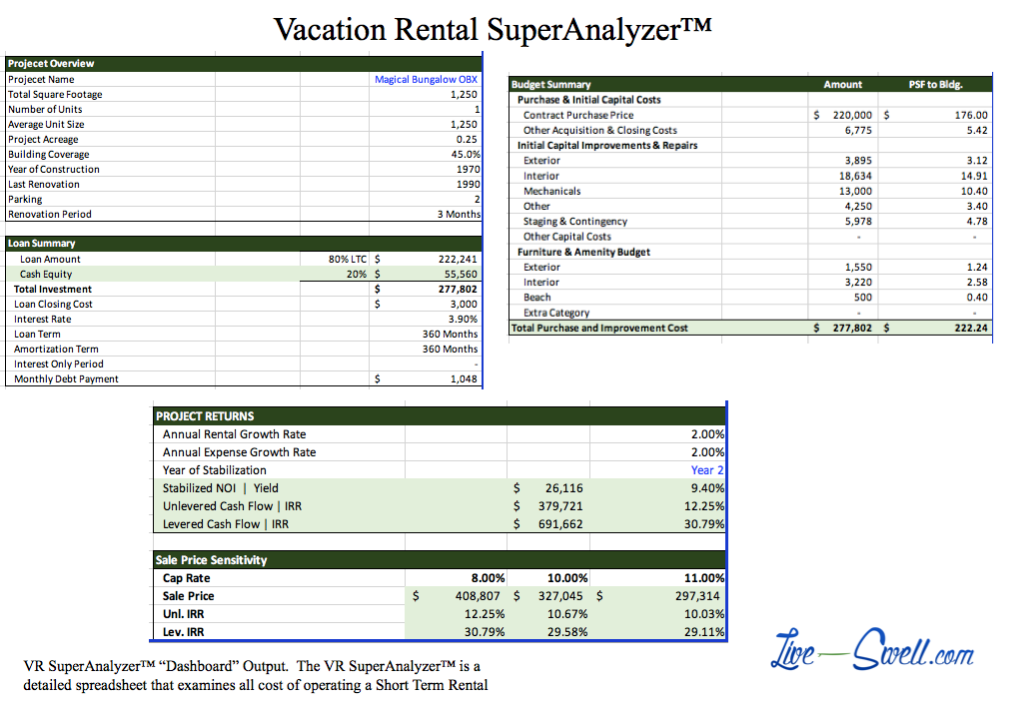

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Rental Property Cash On Cash Return Calculator Invest Four More

Residential Rental Property Depreciation Calculation Depreciation Guru